WPP: Sorrell’s End Game?

WPP was a hero situation from the late 1980s founded by a colossus of advertising, Sir Martin Sorrell, which had managed to stretch its hegemony well into the 2010s. However, time stands still for no one and nothing, and it would appear that the digital transformation of marketing / Madison Avenue has eroded the dominance of this group. At the same time, even hoovering up £70m as a salary cannot defy the ageing process and it may be that the recent base building in the WPP share price at and above the 50 day moving average at 1,320p is the market looking forward to some kind of M&A end game?

Indeed, it should be the case from a charting perspective that at least while above the 50 day line we could see WPP stock recoup some of the lost ground and head back towards the top of a rising trend channel which can be drawn in from as long ago as 1,500p – the same zone as the 200 day moving average currently.

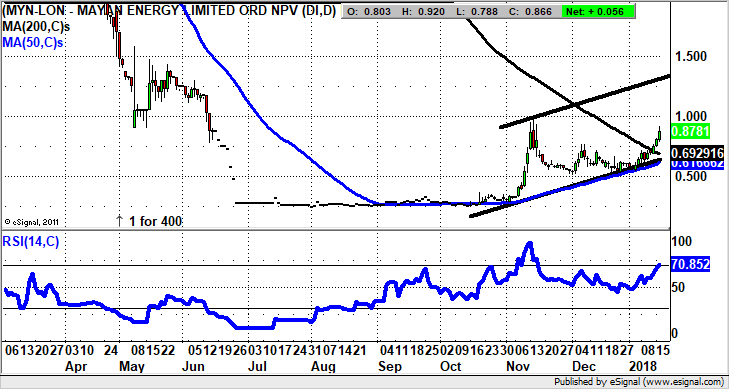

Mayan Energy: 1.3p Technical Target

With Mayan Energy we have been witnessing the slow but sure rehabilitation of a company from both a fundamental and technical perspective. The hope as far as the bulls are concerned is that the realisation of a recovery situation causes the bears to rush for the exit and exacerbate recent gains still further.

Indeed, judging by the daily chart it could be argued the 2-3 months target here could be as great as the rising trend channel from October with its resistance line pointing as high as 1.3p. At this stage only back below the 200 day moving average now well down at 0.69p would even begin to question the solidity of the turnaround here.