Although there is normally more to be gained from identifying minnows that are in recovery mode, for some strange reason today we have the larger companies looking as though they can offer technical traders something out of the ordinary.

Daily Mail:

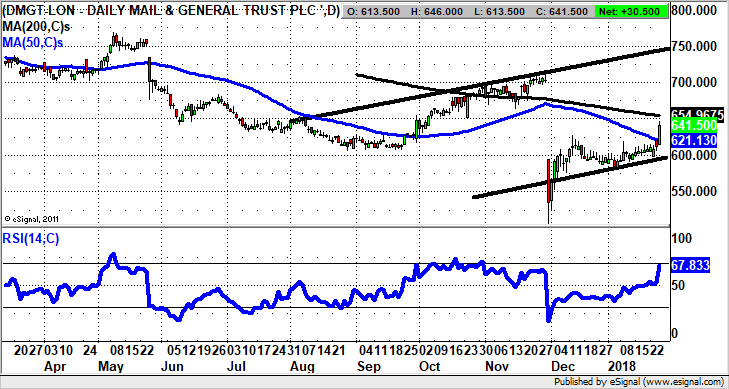

For instance, in the case of my favourite intellectual publication, Daily Mail, the stock of the sidebar of shame group has not only started to fill the recent chart gap above 627p, it has moved through the 50 day moving average at 621p with some force. The implication is that while there is no break back below the 50 day line the upside here could be as great as the top of a rising August price channel at 750p over the next 1-2 months.

Kier:

Kier is not normally a stock for the fast money, but with the latest bear trap gap up reversal through the 50 day moving average at 1.051p we have a situation which is clearly in play. The view at this point is that an end of day close above the 50 day line should give the shares enough momentum to travel at least up to the post September resistance zone at 1,200p plus on a 1 month timeframe.

Smith & Nephew:

By rights sleepy Smith & Nephew should have been gobbled up by a proper international player years ago – Johnson & Johnson or such like. However, the management at the company seem to be happy to hold on limpet like to their presumably rather well paid gig, and the company trundles along not exactly blowing the doors off in terms of extracting shareholder value. But at least there has been a bullish falling wedge breakout this week, with the implication being that provided there is an end of day close back above the 50 day moving average at 1,290p, a return towards the best levels of the past year through 1,400p could be seen over the next 2-3 months. At the same time one rather wishes that this group was back in the frame as a M&A candidate…