It is rare that a small pharma stock has the chance of lending itself to a new phrase in the Oxford English dictionary. But I am going to have a go: The Tiziana Anomaly.

It is that in this company we have an illustration of a stock price whose value has remained almost unchanged over the past couple of months, while almost everything in its space has multibagged.

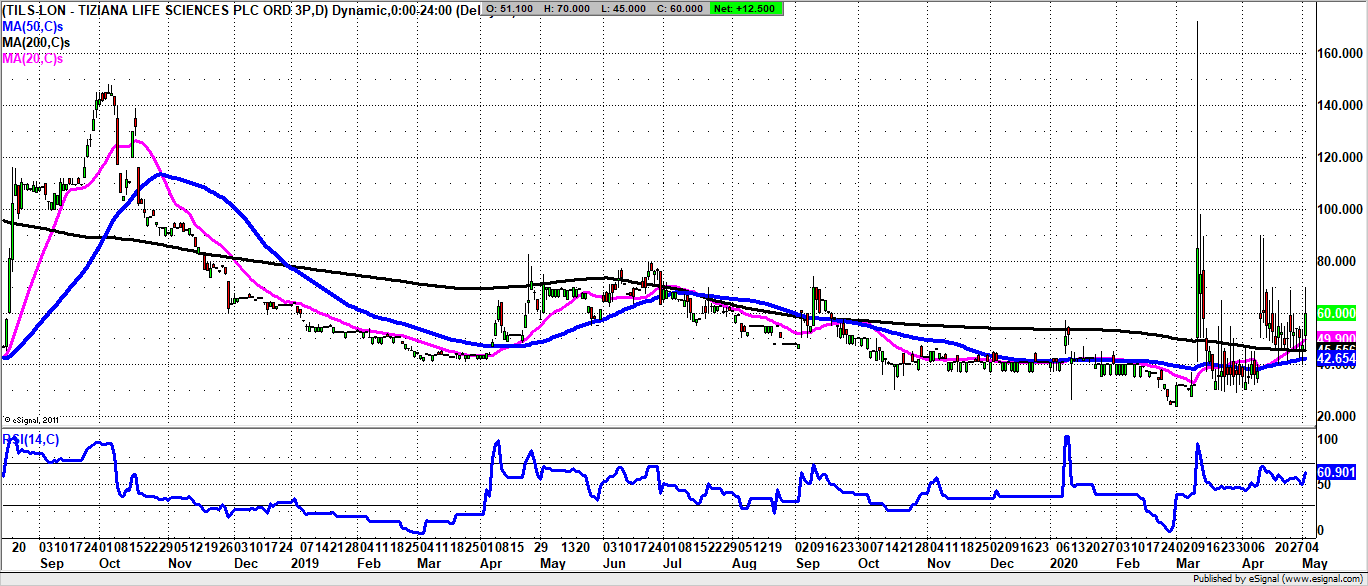

Indeed, we have seen such luminaries as Valirx (VAL) , Scancell (SCLP) and Motif Bio (MTFB) head for the stars, while Tiziana Life Sciences (TILS) shares have hardly moved from a range either side of 50p. Given the breadth and depth of the Tiziana portfolio, this would appear to be a grossly unfair state of affairs.

An example that comes to mind in popular culture (admittedly rather old school) is from the life of the actor Michael Caine when he observed that while all his actor friends were becoming famous in the early 1960s, such as Sean Connery and Terence Stamp, he was still treading the boards in repertory.

Happily, in the end, Sir Michael’s career and position as a national icon, put him up there at the top. So rather than the Tiziana Anomaly, the new concept could be called the Michael Caine Anomaly…

But getting back to Tiziana’s situation now, it may be that the explanation for the delay in recognition is due to the aforementioned depth and breadth. In general, the stock market prefers the one trick ponies to the mini conglomerates – at least in terms of valuation. It is also the case it prefers simple concepts to complex. A test for Covid-19 is much more easy to swallow than getting into the nitty gritty of monoclonal antibodies or inhaler delivery.

However, now that the initial Covid-19 Gold Rush has been seen and enjoyed in the junior market, it may be timely to look at a company that has more strings to its bow than just the present pandemic, and one where its valuation does not give you a sense of acrophobia. To this end it may be worth just focusing on two parts of the Tiziana portfolio:

1. Tiziana’s Kunwar Shailubhai has been the first to publically disclose his pioneering use of an inhaler / nebuliser device which provides a highly efficient and immediate relief to Covid-19 suffers. In fact, last week on CNBC, Gilead – a leader in the Covid battle with its anti-viral drug Remdesivir, confirmed it is evaluating different formulations – including delivery via inhaler. This comes after Tiziana’s recent patent filing for its proprietary inhaler technology to deliver its anti-inflammatory lung Covid-19 treatment TLZS-501, as well as other drugs.

2. Just as important as the inhaler treatment concept relating to Covid-19 is Tiziana’s breast cancer prognosis test. StemPrintER is due to be on the market as soon as next year, and set to be confirmed as the new market leader. Speculation is growing as we are in the run up to this month’s American Society of Clinical Oncology conference.

The kicker here is that Exact Sciences paid $2.8bn for Genomic Health last year in buying its Oncotype DX test, a breast cancer test which currently generates $300m in revenue. This revenue is 3 times the present market cap of Tiziana, and not even included on the balance sheet.

Given that diagnostics is now the new rock and roll in the wake of Covid-19, one would expect this situation to change rather quickly, and the Tiziana Anomaly of a modest valuation as compared to its peers will be no more.

Disclaimer

Zakmir.com is a purely journalistic website – Zak Mir is a member of the National Union of Journalists. There is no intention here of providing financial advice. It is recommended you seek an independent professional opinion before deciding whether or not to take any action with regard to anything written here.