Rather like last week’s Life of a Chart entrant – Eurasia Mining (EUA), inventory monetisation company, Supply@Me Capital has deeply divided FinTwit and the bulletin boards. Obviously a stock which rises many fold is always catnip to shorters, who exaggerate the negatives, exclude the positives, and then go for a heady mix of character assasination, plus a threat to go to the regulator. All of this of course, is guilty until proven innocent, which is certainly not in the spirit of Magna Carta.

The Great 2020 Small Caps Bull Market

But to paraphrase a market cliche, small caps can rise / overshoot in current conditions for far longer than the bears can remain solvent. We saw that at Eurasia as well. Perhaps the key point though, is that now, even more than the Dotcom bubble, we are in a massive bull market for small caps. You may temporarily be onside, but going short currently is a perilous business.

Inventing A New Kind Of Wheel?

Part of the opportunity in small caps and the effect of the pandemic, is that it has inspired a need for new ideas in funding, due to companies needing to maintain as healthy a balance sheet as possible in the present challenging environment. On the face of it, by making inventory an asset class Supply@Me has perhaps not so much reinvented the wheel, but even created a new type of wheel. This would certainly explain the £200m market cap, and the way that the Chairman of the company, was happy to buy £1.5m of stock after it had multi-bagged on August 19. We shall hopefully be fully enlightened when I interview CEO Alessandro Zamboni on Tuesday.

The Great Breakout

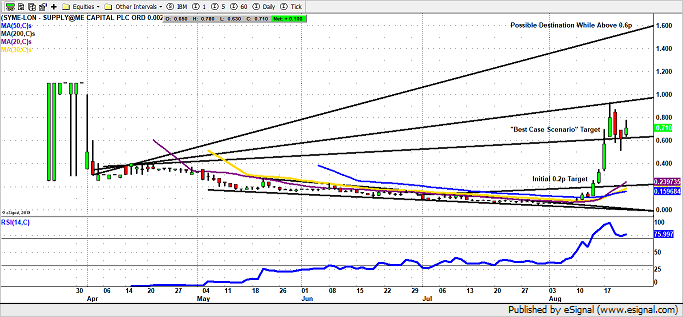

Getting back to Supply@Me on the technical side, and purpose of Life of a Chart, the question is whether one could have got on board the move from under 0.05p a few weeks ago, to the 0.92p peak last week? I would argue that one could, even though the run up to the chart breakout at 0.06p on August 6, or the gap higher for a 0.08p entry on the open the follow day? Interestingly enough, a long entry on either day would have endured minimal pullback ahead of the 10 fold increase that was about to begin.

But let’s dial back to the set up. It is normally the case that the greatest rallies are by definition preceded by price action that will ensure that as few traders as possible are on board when the big move happens. Very often this will consist of multiple new narrow lower lows, before a slingshot effect propels the stock higher. We may be seeing just such a set up at Calisen (CLSN). However, in the case of Supply@Me, May, June and July all witnessed false dawn rallies in which the stock price doubled before retreating from the 30 day moving average – in yellow on the chart. At the same time this descent was within a hyper thin wedge / funnel on the daily chart. While the stock remained within the wedge one could stand aside, avoiding the bull traps.

The Wedge

The first big change and early bird buy signal was on August 6 when the shares finally broke out of the wedge, with an end of day close at 0.06p. There was the choice of buying on the close that day or the open the following day. Indeed, one had the whole of August 7 to go long. On August 8 the shares gapped up on the open – the gap confirming the long jam breakout, and the rest is history.

Best Case Scenario

What we did have once Supply@Me was on its was an initial 0.2p July triangle target, and a “best case scenario” destination of 0.6p. Both of these were mentioned ahead of time in the Bulletin Board Heroes video. 0.6p was later upgraded to 0.9p, and lastly to 1.5p – which seems incredible. Ideally the shares now remain above former resistance at 0.6p ahead of any further upside. At this stage while above 0.39p April resistance keeps the stock in bull mode.