Jubilee Metals appear well positioned in Zambia to take full advantage of their Sable Zinc Refinery acquired from Glencore.

The facility is well located and Jubilee purchased it for the processing of their Zinc/Lead/Vanadium project acquired from BMR. The acquisition was strategic from the point of view that they would spread their wings into a neighbouring country, sharing political risk, foreign exchange risk and commodity risk.

As if to offset sector wide uncertainties in the wake of Covid-19’s arrival earlier this year, this acquisition has opened up a real box of opportunities in a timely manner, and this will not be confined to Zinc/Lead/Vanadium.

Jubilee’s recently announced acquisition and associated statements make it clear that whatever the prospects for Zinc/Lead/Vanadium might be, Copper – arguably one of the hottest metals now in the wake of the electric vehicles revolution, is at the top of the agenda.

The company’s latest deal is certainly more than being with a famous name in terms of Glencore, it clearly represents a major step forward in size and commodity as you would expect when rubbing shoulders with one of the best known multinational mining groups. The Luanshya Mine was one of the Copper belt’s major mines and consequently the dump is enormous. Indeed, it is no longer about Jubilee talking about 5-10million tonnes, they are now talking 150 million tonnes.

Overall this seems to be a very time move for Jubilee, placing it in a metal that is showing resilience in this difficult times and real prospects for the future. The fundamentals for copper appear to be stronger than ever, not only with the emergence of electric vehicles, but also the metal’s role in revitalising dilapidated infrastructure and the addressing the industrial needs of emerging nations. Jubilee has already shown strong earnings from South Africa and all the suggestions are that those earnings will be repeated in Zambia on similar timescales.

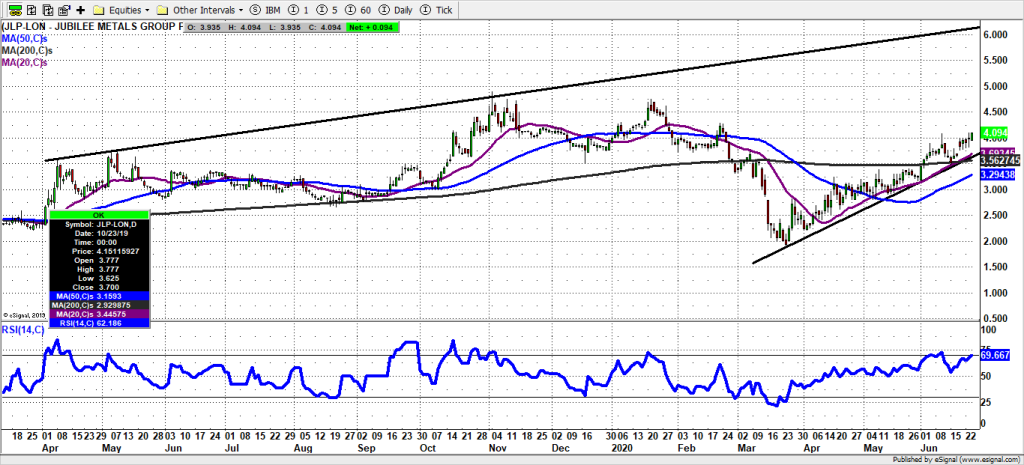

This should mean that the post March share price rebound for Jubilee Metals continues, with the recent break above the 200 day moving average on the daily chart officially underlining the stock’s new bullish credentials. Indeed, it could be the case that while above the 200 day line the shares will head towards a 2019 resistance line projection at 6p over the next 1-2 months. The way that the stock appears to be heading into a so called Golden Cross buy signal only underpins the feel good factor, both technically and fundamentally at the moment.

Disclaimer

Zakmir.com is a purely journalistic website – Zak Mir is a member of the National Union of Journalists. There is no intention here of providing financial advice. It is recommended you seek an independent professional opinion before deciding whether or not to take any action with regard to anything written here.