Asiamet Resources (ARS): 2.3p

Copper developer Asiamet at 2.3p and market capitalisation of £46million feels distinctly out of place given its assets, history, and management team. Certainly, the technicals indicate that it is ready to move following its February fundraise for £10m where word on the street is that most short termers have moved on; we shall have to see. Following the potential acquirers for Asimet’s flagship BKM development stage copper asset pull out of a legally binding contract to buy the asset for a headline figure of £163m the company’s share price was sold into significantly coming off from a pre-deal 6p. The would-be acquirers tried to put the squeeze on and cut a better deal after the contract was inked and whether rightly or wrongly the company walked away.

What hasn’t changed is the fact that Asiamet still has around a 2.5 million tonne copper inventory with the BKM asset not only on China’s doorstep but one of the few near construction ready projects of its size in Asia (Indonesia actually with a population over 200m and one of the fastest growing economies in the world). Using a copper price as low as $3.25/lb in their feasibility study and with an NPV of U$124m, life of mine revenue of U$1.27 billion and the construction licence nearly in the bag BKM is clearly a takeout candidate or in play to be dealt on in terms of strategic partners. Don’t forget that the copper price is rip roaring since the 2019 feasibility study was delivered and well over $4/lb today since significant players calling for further upside.

Asiamet pulled off the deal that was never to be at a low in the market, copper is hot stuff now and the company now has more than a fair wind behind its sails and is moving towards tinkering with its processing methods at BKM with signs that it may be able to improve upon project economics significantly through addition of further years of mine life and basically producing more copper quicker and thus cashflows quicker too. Strategy now simple – get the numbers up through engineering changes and further drilling around the prolific KSK licence aiming for a full sale of the asset for the right price or launch into construction aided by a partner or even more interestingly funding construction themselves through an IPO spin-out of the asset onto a local exchange. Buy whilst the company is on one knee, with plenty of cash to generate work and newsflow Asiamet could be running on two feet again soon. Definite takeout target potential. With construction permits getting closer some of jurisdiction risk can be mitigated, execution risk is delivering upon corporate activity however they have a team who have done it all before now with something to prove. Buy and add with progress, moves quick when it is in the mood.

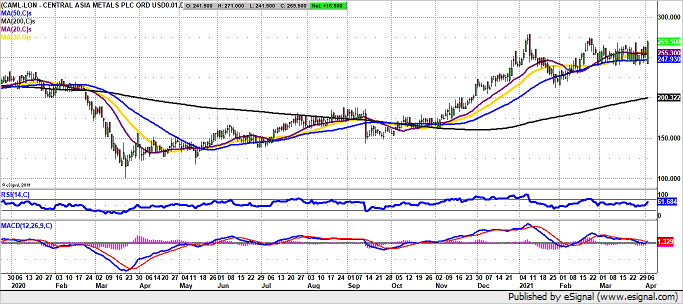

Central Asia Metals (CAML): 268p

A bit of a darling of the mid-cap mining world and pays a nice dividend too. Key words are copper (plus zinc and lead), low-cost and dividends – CAML announced an 8p final dividend recently which brings its total 2020 dividend payouts to 14p per share. Its dividend payout also represents over 57% of its free cashflow, note also that it paid off $38.4m of debt in 2020 and with only $36.2 million left as of Dec 2020 investors should expect it to be debt free at the end of this year – could mean further growth in the dividend? CAML has cash in the bank of $47.9 million and with its two projects in production it seems not much else to spend it on.

2021 has seen the highest copper prices in 8-10 years and strong for zinc and lead too, with some of the lowest C1 costs of production in the world, high prices may reflect very favourably for CAML going forward especially if it can maintain production guidance. Production numbers are released quarterly for the market to dig into, expect growth in dividends and revenues and steady output from the two existing assets. Perhaps time for the company to take a bit of risk and bring in a couple of new projects for further growth. Risk is mainly operational with delivering its numbers but they know what they are doing, market risk with commodity prices but these are expected to stay strong for some time to come. Buy for slow steady growth and dividend, boring is good.

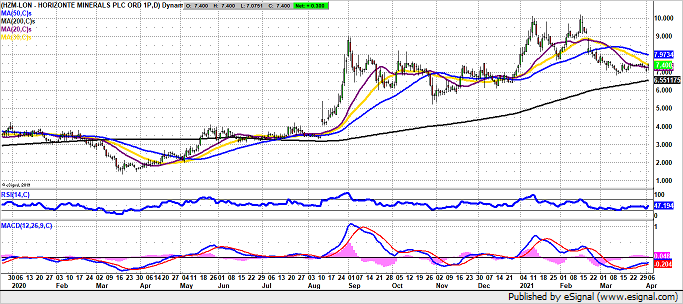

Horizonte Minerals (HZM): 7.1p

Investors would be hard pressed to find a development stage company listed on the London Stock Exchange screaming quality as Horizonte Minerals which is developing two, tier one nickel projects in Brazil. The Araguaia ferronickel project and the Vermelho nickel-cobalt project are both high grade, lowest cost quartile, long mine life projects. Combined, the projects provide Horizonte with a scalable production profile of ~50,000m tonnes of nickel per year and positions the company excellently in terms of being able to supply nickel to both the stainless steel and the EV battery market, achieving production from both mines would position Horizonte in the top nickel producers globally. Nickel is a critical component in both stainless steel and new battery technology and institutional investors seem to be queuing up to give Horizonte their money. Remember that nickel is a key enabler of the clean energy transition and Horizonte say that “As a member of this sustainability driven supply chain Horizonte is developing its operations focused on producing a low carbon product, ethically, safely and responsibly”

Horizonte say that Significant progress has been made on the overall Project Finance package for the development of Araguaia and it is this which the market is waiting for. Following a recent raise bringing in north American institutions Horizonte is sitting on c£30million in cash, more than enough to process on detailed design engineering for its projects and progress the rest of its financing. The company has indicated that the U$325m debt portion of its overall financing has been progressing and mandated five big name international financial institutions including BNP Paribas, ING, Mizuho, Natixis, Soc Gen to sort this out for them. Interestingly investors should note that BMO Capital Markets were recently also brought in as joint broker – worth paying attention when these guys get involved as they have global reach with all the best mining institutions.

Financing, financing, financing that is what the market cares about at the moment but HZM seem to have it in their stride, the debt piece seems to have all the big boys on the case but what about the equity and offtake? Well, first-off we have already seen HZM pull off a $25m royalty agreement with Orion Mining Finance investors should take some confidence that Orion are involved as they are capable of deploying large amounts of capital to get projects into construction. Investors should also note the presence of Glencore (5.5%) and Teck (13%) on the shareholder register – powerful and deep pocketed friends to have indeed. HZM have already indicated that there is a “non-binding, conditional term sheet agreed with one major cornerstone equity investor” any ideas as to who this might be? Q2 / H1 has been reiterated a few times as likely for the whole financing piece to be announced, given the project economics with C1 costs of US$6,794 a tonne and present nickel prices of c$16,000/tonne and a lot of the hard work done, it is not hard to see Araguaia as being easily financeable. Investors looking forward to jumping on the EV and stainless driven growth wave for nickel could possibly not do better than Horizonte as it moves through financing and into construction. Timing and execution risks but again a great deal of the hard work has been done already. Buy, accumulate and hold as HZM complete the financing pathway and before nickel goes to the moon. Or this company gets taken out for its two yes two tier-1 projects…

Disclaimer:

Zakmir.com is a purely journalistic website – Zak Mir is a member of the National Union of Journalists. There is no intention here of providing financial advice. It is recommended you seek an independent professional opinion before deciding whether or not to take any action with regard to anything written here.