Given the way that in the past couple of weeks there has clearly been some end of tax year / waiting for the new ISA reset on April 6 jiggery pokery in the stock market, it seems only fair that there could be a run up in shares as people take up their 2021 allowance of up £20,000. With this in mind the following are some companies to consider placing in a tax shelter:

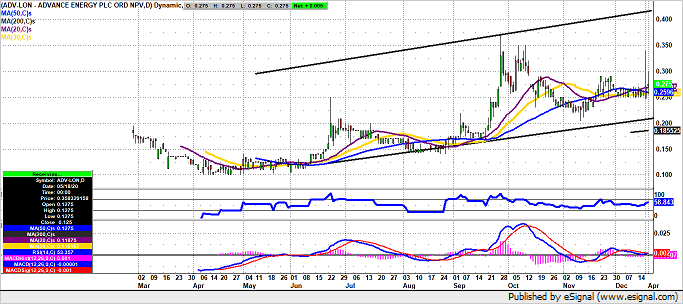

Advance Energy (ADV): 0.29p

Let’s throw what was only a few weeks ago a £5m market cap minnow into this year’s oily ISA consideration list and consider Advance Energy who, whilst the market was thinking about its upcoming Easter holiday, comfortably nailed a $30million capital raise to complete their acquisition of a significant 50% interest in the Buffalo Oil field in Timor-Lest. Through the Buffalo field, the company is targeting “exposure to material upside potential in 2021 with limited risk” and says that the now fully-funded B-10 appraisal well at Buffalo has potential to deliver production of 40,000 BOPD within 3 years of the drilling of B-10. Some big numbers there which oil drill speculators typically like, and those numbers combined with the lower risk appraisal nature of B-10 is going to attract a lot of interest for not only the “thrill of the drill investors” but more sensible types too and why not – Advance says that the Buffalo field originally developed by BHP and Nexen in 1999 produced 21 MMstb over 5 years and hit peak rates of 45,000 bopd from 2 previous wells before being shut-in in 2004 at 4,000 bopd.

The team at Advance claim that there is still considerable resource potential at Buffalo and say that modern 3D reprocessing has “delineated an undrilled crest” at Buffalo with certified 2C (contingent resources) estimated remaining oil in-place of 85 MMstb (stock tank barrels). Drilling is planned for H2 of 2021 and the highly experienced management team expect Buffalo to be the first addition to the Advance portfolio from a pipeline of other potential exciting opportunities. Speaking of the team, these guys have had senior leadership roles at several respected major to mid-cap oil and gas companies and have repeatedly identified and developed a number of significant oil and gas plays, importantly they have also put their money where their mouth is and have bought significant stakes in Advance. Given drilling success shareholders should be in safe hands. Note that there will be time between any successful drilling and first oil but with Advance modelling Free cash Flow at circa $276million in Buffalo’s first year of production it could well be worth waiting for. Buy for the lower risk drilling opportunity and management team, note the upcoming EGM on 16th April to approve acquisition and share consolidation.

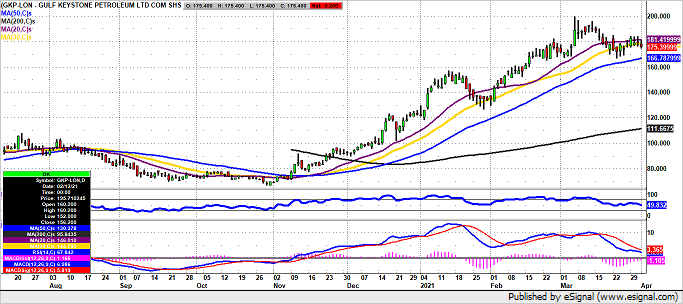

Gulf Keystone (GKP): 175p

This one is relatively easy to sum up – currently producing a whopping 43,190 bopd from their Shaikan field in the Kurdistan region of northern Iraq and aiming to increase to 55,000 bopd by Q1 2022 beginning with the drilling of the SH-13 well in Q3 of 2021, GKP are valued at £369m and are sitting on a cash pile of $161m

With one of the lowest Opex around at $2.6/bbl, GKP are heavily leveraged to oil prices and with record production levels for 2021 must be loving these current oil prices – recently being described as a ‘cash machine’ by a well-known investment analyst. Also, with the resumption of regular payments to GKP from the Kurdish Regional Government (“KRG”) for the last eleven months and the demise of ISIS political risk has diminished considerably. Repayment mechanisms are in place to recover outstanding arrears of $73.3 million too.

Confident enough to re-instate its annual dividend beginning with $25m this year and stating that with ‘continuing strong oil prices, there may be opportunities to consider further distributions to shareholders this year”. Growing production, growing cash, dividends back in place (possibility to grow), lowering costs, strong oil prices. Buy for growth and dividend. Risks have shifted from political to the oil price.

United Oil and Gas (UOG): 4.8p

With a relatively low market valuation (£29m) as compared with consistently rising production levels (c3,200 bopd) on the back of its exceptionally well-structured deal for its Egyptian licence acquisition (22% owned), the ambitious United Oil and Gas Plc seem to be doing most things right and could be one stock to gain significant traction for both holders and new entrants from these levels especially into what may turn out to be a continuing strong oil price environment for 2021 and ahead (in fact an oil supercycle as analysts at several major investment banking houses are calling).

United under well regarded and enthusiastic CEO Larkin has had 3 out of 3 hits in drilling wells in Egypt and promises a busy 2021 ahead with x2 more fully funded wells drilled thus year. If the ASD-1X well presently being drilled is anything like the gushers that predecessors ASH-2, ES-5, ASH-3 were then it could be a step change for the company. Helped by some of the lowest operating and corporate costs around, United did well to declare a maiden profit in the first half of 2020 and on the back of only four months of production and a period of very low oil prices across the sector. Oil is trading in the mid $60’s again and drilling at United’s Egyptian fields have historically carried a high chance of success. 2020 final results worth looking forward to but 2021 will put the meat on the table. Well managed financially, fully funded for operations, carries usual drilling risks but field has been delivering well thus far. Strong buy and lock up as they grow.

Disclaimer:

Zakmir.com is a purely journalistic website – Zak Mir is a member of the National Union of Journalists. There is no intention here of providing financial advice. It is recommended you seek an independent professional opinion before deciding whether or not to take any action with regard to anything written here.