There have been plenty of false sunsets for the bull market in stocks, with numerous factors – including the 10th anniversary of the fall of Lehman Brothers being wheeled in as possible triggers. The current set up is no less a convincing excuse to be bearish, especially given the trade wars anxiety and soaring Italian bond yields.

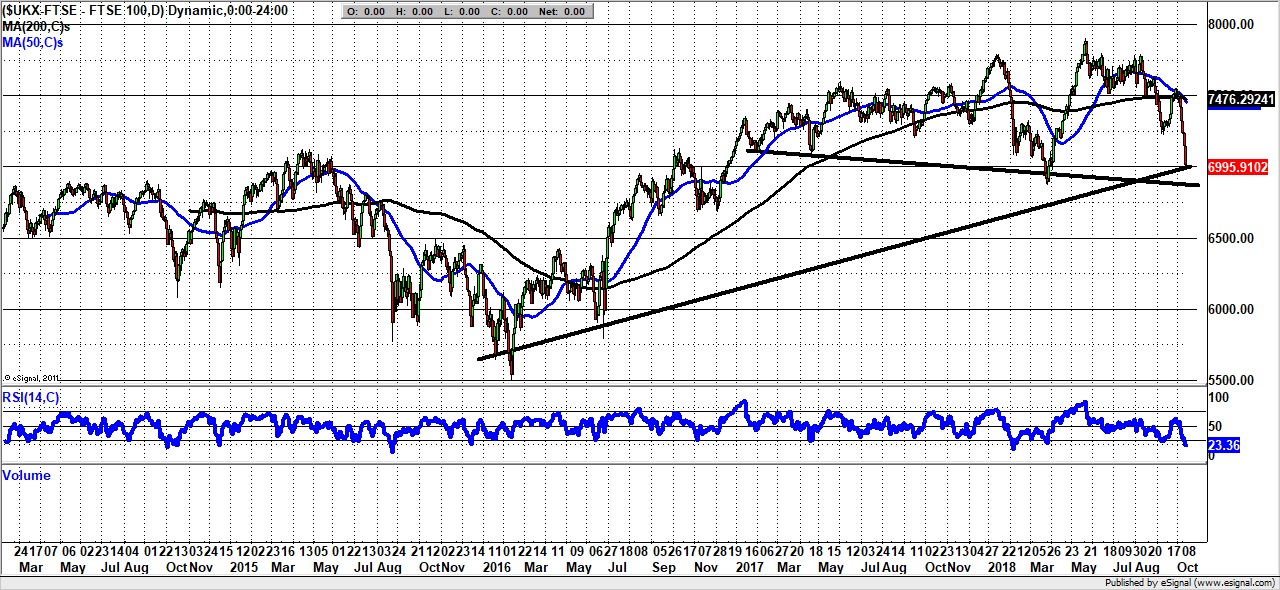

As far as the nitty gritty of the technicals on the UK’s leading stock index, it can be seen how both the falling 50 and 200 day moving averages crossed down last week – the classic Death Cross.

Alas, this was the same set up as was seen in March. Then the market fell just 300 points, before soaring to new highs. It was not quite a false signal, but would have been quite painful for the bears if they were hoping the FTSE 100 was heading for an extended meltdown.

Perhaps learning the lesson of the early part of this year, it may be best to combine not only the death cross, but also a trendline or two. For instance, 7,000 marks the level of an uptrend line from the beginning of 2016. A weekly close this week below this round and psychological number, may be the best additional trigger to go for. Ideally, such a close would also be below the currently 6,866 2018 support below which the rounded top on the FTSE 100 really should take it back towards 6,000.

At this stage only back above last month’s 7,220 low really gets leading UK blue chips out of trouble.