A Green Technology Winner

As a corporate these days on the stock market, you know that you are in a hot space, if the latest Spac is one which is focused on your line of business. This is certainly the case as far as Ceres Power, a global leader in fuel cell and electrochemical technology. The other positive Litmus test of the moment happens when you move to raise money and investors bite your hand off. This has also happened at Ceres Power this week, as it raised £180 million, a move which has just been completed.

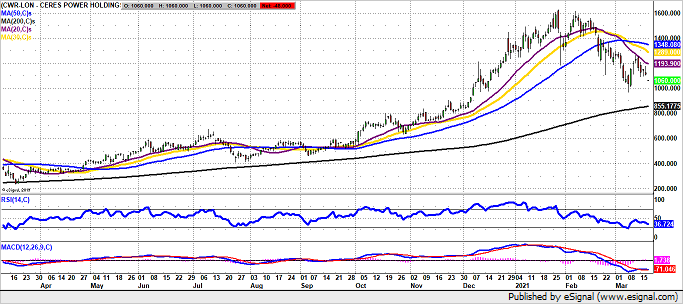

The daily chart shows the shares have found support at the 200 moving average and a retracement target towards 1,300p as initial target, which is a 50% Fibonacci retracement from the February high of 1,600p and March low of 1.000p.

The Ceres Edge: Solid Oxide electrolysis

Ceres Power is a world leader in solid oxide fuel cell (SOFC) technology, and over the past 12 months, has strengthened its position in the market. One promising additional application for Ceres’ SOFC technology is in the development of solid oxide electrolysis (SOEC) technology, essentially reversing the operation of fuel cells to produce hydrogen from electricity, which can produce green hydrogen when using renewable energy. SOEC is the most efficient electrolyser technology, with a 75 – 85%+ level of electrical efficiency1 with the potential to help drive decarbonisation of industrial processes such as steel and ammonia production.

The Addressable Market: 50 Million Tonnes

According to Ceres Power there is a potential total addressable market of over 50 million tonnes of green hydrogen production per annum from SOEC technologies representing a US$0.6-1.1 billion future royalty opportunity for Ceres. The net proceeds of the Fundraise will principally be used by the Group to accelerate its investment in the development and potential commercialisation of its differentiated SOEC technology, enabling Ceres to expand its presence in what the Group considers to be an attractive, high value future market in green hydrogen production for industrial applications.

Solid Oxide Fuel Cell

Ceres is also aiming to become the industry standard in SOFC, and so part of the net proceeds of the Fundraise will be used to further develop the application of Ceres’s SOFC technology into significant additional addressable markets such as utility scale power and marine applications. The Group also intends to continue to develop its technology to operate with future energy inputs such as ammonia or synthetic fuels.

In terms of deals have been concerned, in October Ceres announced an expansion of its strategic collaboration with Doosan Fuel Cell, and in December an extension of its strategic partnership with Bosch was unveiled.

Growth Strategy

These partnerships represent an initial target capacity of 250MW and are core to the Group’s growth strategy. The net proceeds of the Fundraise will therefore also be used to strengthen the delivery of these and other partnerships, by increasing investment in operational infrastructure and engineering support as Ceres’s partners scale up their manufacturing capabilities in advance of mass market launches in 2024.

Part of the net proceeds of the Fundraise will be used to invest in the core business to accelerate innovation and to maintain technology leadership across both SOFC and SOEC. The cash will also be used to expand R&D, engineering and advanced manufacturing capabilities, as well as providing further capital for IP generation and acquisition.

Disclaimer:

Zakmir.com is a purely journalistic website – Zak Mir is a member of the National Union of Journalists. There is no intention here of providing financial advice. It is recommended you seek an independent professional opinion before deciding whether or not to take any action with regard to anything written here.